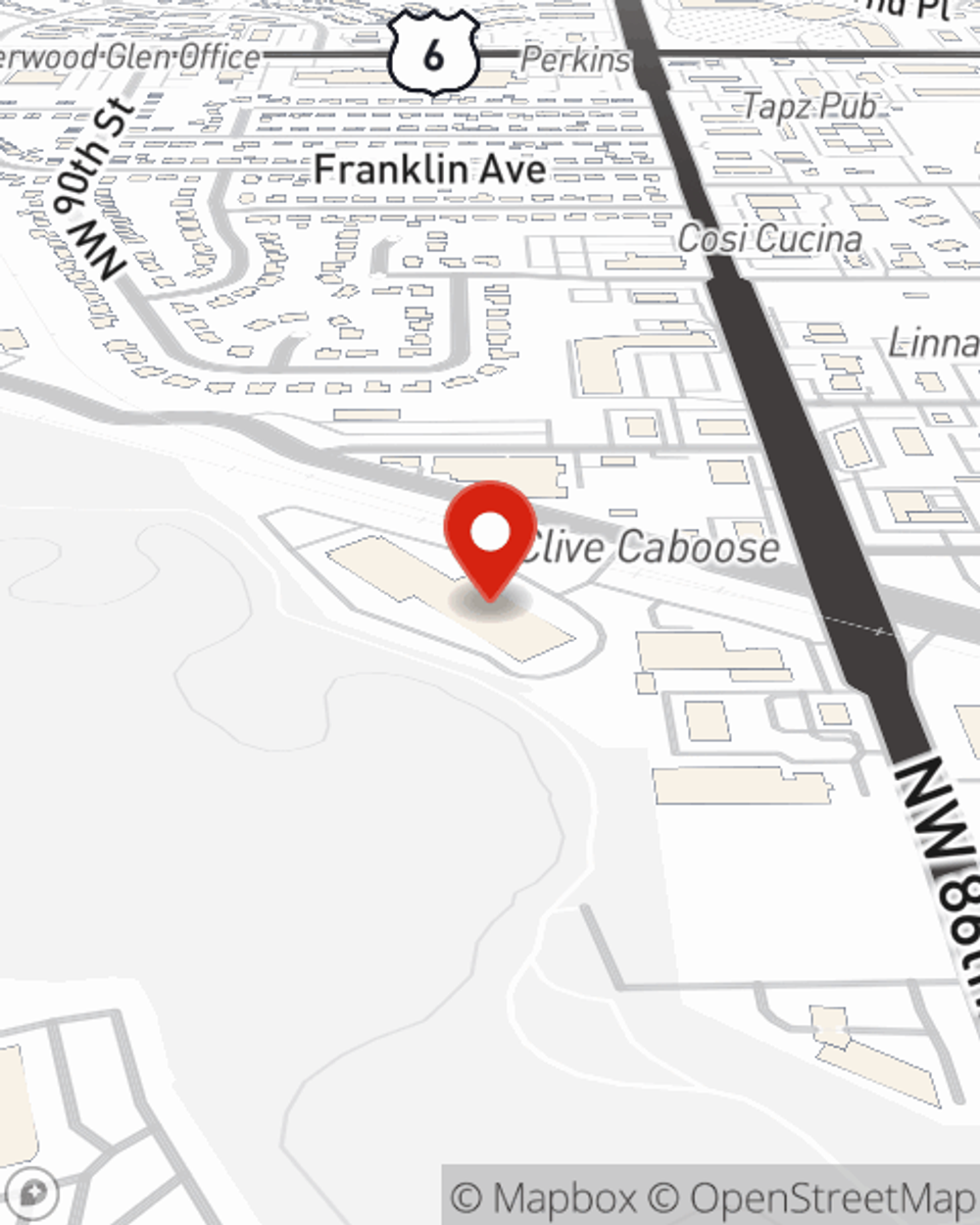

Condo Insurance in and around Clive

Here's why you need condo unitowners insurance

Quality coverage for your condo and belongings inside

- St. Louis, MO

- Omaha, NE

- Minneapolis, MN

- Cedar Rapids, IA

- Davenport, IA

- Des Moines, IA

Condo Sweet Condo Starts With State Farm

Owning a condo is a lot of responsiblity. You want to make sure your condo and personal property in it are protected in the event of some unexpected catastrophe or mishap. And you also want to be sure you have liability coverage in case someone gets hurt on your property.

Here's why you need condo unitowners insurance

Quality coverage for your condo and belongings inside

Why Condo Owners In Clive Choose State Farm

You can kick back with State Farm's Condo Unitowners Insurance knowing you are prepared for the unanticipated with dependable coverage that's right for you. State Farm agent Kelli Kerton can help you understand all the options, from possible discounts, replacement costs to bundling.

Get in touch with State Farm Agent Kelli Kerton today to see how one of the well known names for condo unitowners insurance can help protect your condominium here in Clive, IA.

Have More Questions About Condo Unitowners Insurance?

Call Kelli at (515) 277-7227 or visit our FAQ page.

Simple Insights®

Help protect yourself from contractor fraud

Help protect yourself from contractor fraud

Shady contractors and home repair scams can cost you. Discover tips to help protect yourself from repair scams and learn how to spot home repair fraud.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

Kelli Kerton

State Farm® Insurance AgentSimple Insights®

Help protect yourself from contractor fraud

Help protect yourself from contractor fraud

Shady contractors and home repair scams can cost you. Discover tips to help protect yourself from repair scams and learn how to spot home repair fraud.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.